Choosing and using a credit card wisely is an essential aspect of personal finance management. When selecting a credit card, it’s important to consider factors such as interest rates, annual fees, rewards programs, and the credit limit. Look for a card that aligns with your spending habits and financial goals, whether it’s earning cashback, travel rewards, or building credit. Once you have a card, use it responsibly by paying off the full balance each month to avoid interest charges and maintain a healthy credit score. Set a budget to prevent overspending and track your expenses regularly. By understanding the terms and benefits of your credit card, you can maximize its advantages while minimizing potential financial pitfalls.

In today’s financial landscape, credit cards have become an essential tool for managing personal finances. They offer a convenient way to make purchases, build credit, and even earn rewards. However, choosing and using a credit card wisely is crucial to avoid potential pitfalls. Here’s a guide to help you navigate the world of credit cards effectively.

Understanding Credit Cards

A credit card is a financial instrument that allows you to borrow money up to a predetermined limit to make purchases or withdraw cash. Each month, you receive a statement detailing your transactions, and you’re required to pay at least a minimum amount by the due date. Failure to do so can result in interest charges and impact your credit score.

Choosing the Right Credit Card

- Assess Your Needs:

- Determine how you plan to use the card. Are you looking for rewards, building credit, or needing a low-interest rate for balance transfers?

- Understand the Types of Credit Cards:

- Rewards Cards: Offer points, cashback, or miles for purchases.

- Balance Transfer Cards: Provide low or 0% introductory interest rates for transferring existing debt.

- Secured Cards: Require a security deposit and are ideal for building or rebuilding credit.

- Low-Interest Cards: Feature lower interest rates, beneficial for carrying a balance.

- Compare Fees and Interest Rates:

- Look for annual fees, foreign transaction fees, and late payment fees.

- Compare the Annual Percentage Rate (APR) for purchases and cash advances.

- Check the Credit Card’s Terms:

- Read the fine print to understand the grace period, how interest is calculated, and the penalties for late payments.

- Examine the Rewards Program:

- Ensure the rewards align with your spending habits. Consider the redemption options and expiration of rewards.

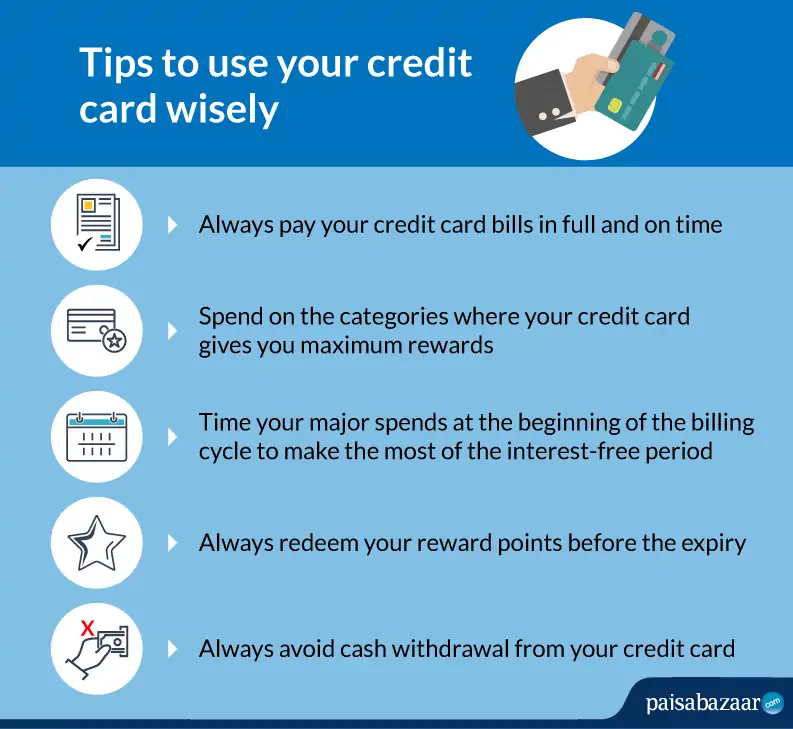

Using a Credit Card Wisely

- Pay Off the Balance Monthly:

- Aim to pay off the full balance each month to avoid interest charges and maintain a healthy credit score.

- Keep Your Credit Utilization Low:

- Try to use less than 30% of your credit limit to positively impact your credit score.

- Make Payments on Time:

- Set up automatic payments or reminders to avoid late fees and damage to your credit score.

- Monitor Your Statements:

- Regularly review your statements for unauthorized charges or errors.

- Leverage Rewards and Benefits:

- Use your card for purchases that earn rewards, but make sure to stay within your budget.

- Stay Informed:

- Keep up with any changes in your credit card terms and stay informed about your credit score and financial health.