Understanding the different types of car insurance coverage is essential for making informed decisions about your auto policy. Car insurance typically includes several core components: liability coverage, which covers damages or injuries you cause to others; collision coverage, which pays for damage to your vehicle from accidents; and comprehensive coverage, which protects against non-collision incidents like theft or natural disasters. Additionally, there are specialized options such as uninsured/underinsured motorist coverage, which safeguards you from drivers without adequate insurance, and personal injury protection, which covers medical expenses regardless of fault. By familiarizing yourself with these options, you can tailor your coverage to suit your needs and ensure adequate protection on the road.

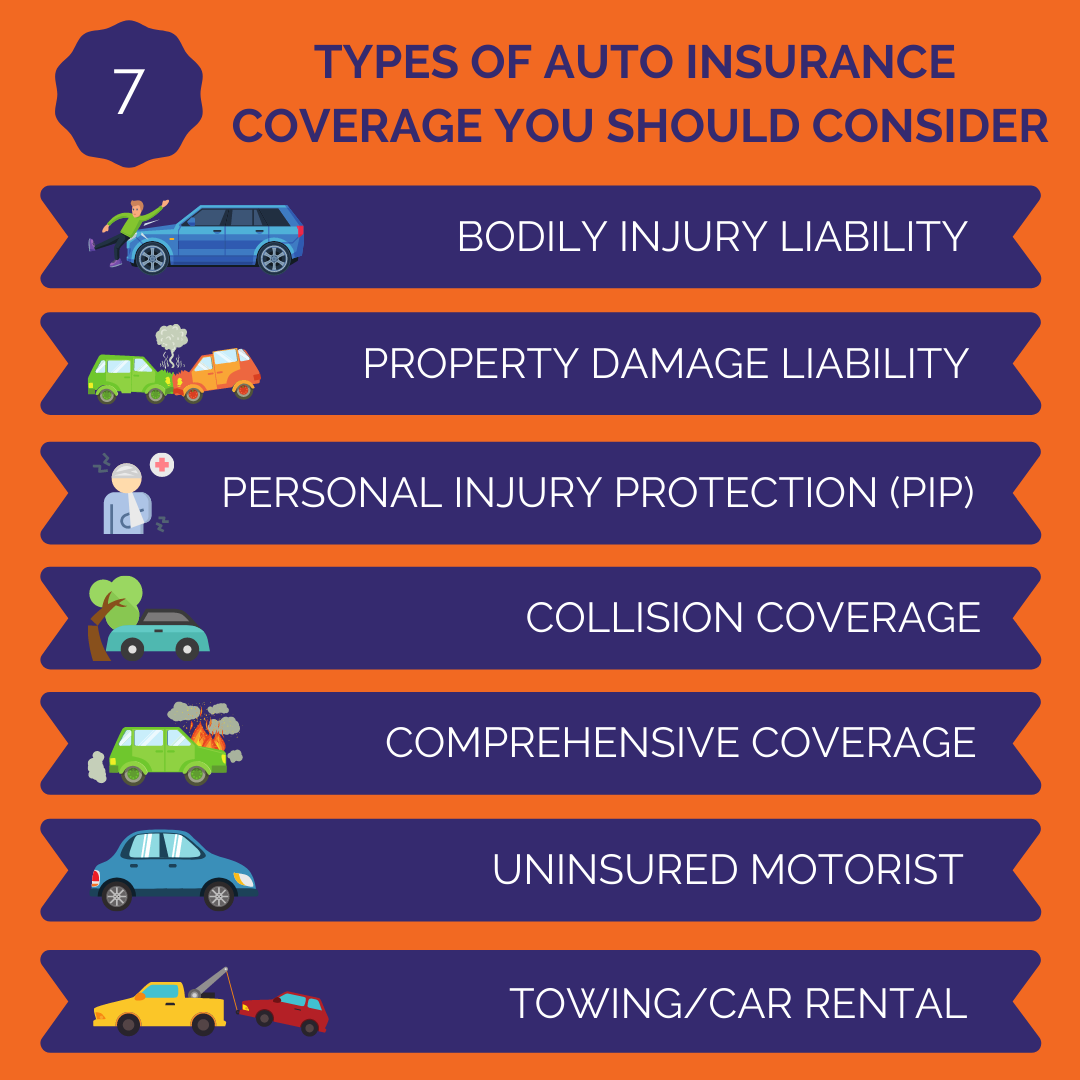

Car insurance is an essential component of responsible vehicle ownership, providing financial protection against accidents, theft, and other unforeseen events. Understanding the different types of car insurance coverage available can help you make informed decisions when selecting a policy. Here’s a comprehensive guide to the main types of car insurance coverage:

- Liability Insurance

- Bodily Injury Liability: This coverage pays for injuries that you cause to another person in an accident. It covers medical expenses, legal fees, and lost wages for the injured party.

- Property Damage Liability: This covers the cost of damage you cause to another person’s property, such as their car, fence, or building.

- Collision Coverage

- Collision coverage pays for damage to your vehicle resulting from a collision with another car or object, such as a tree or guardrail. It typically includes the cost of repairs or, if the car is totaled, the actual cash value of the vehicle minus any deductible.

- Comprehensive Coverage

- Comprehensive coverage protects against non-collision-related incidents, such as theft, vandalism, natural disasters, falling objects, and animal collisions. Like collision coverage, it usually involves a deductible.

- Personal Injury Protection (PIP)

- Also known as “no-fault insurance,” PIP covers medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. It is mandatory in some states and optional in others.

- Uninsured/Underinsured Motorist Coverage

- This type of coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or whose insurance is insufficient to cover the damages. It can cover medical expenses, lost wages, and in some cases, property damage.

- Medical Payments Coverage (MedPay)

- MedPay covers medical expenses for you and your passengers after an accident, regardless of fault. It is similar to PIP but generally more limited in scope.

- Gap Insurance

- If you owe more on your car loan than the car’s current market value, gap insurance covers the difference if your vehicle is totaled or stolen. This is particularly useful for new cars that depreciate quickly.

- Rental Reimbursement Coverage

- This optional coverage pays for a rental car while your vehicle is being repaired after a covered accident.

- Roadside Assistance

- Roadside assistance provides services such as towing, battery jump-starts, and tire changes if your car breaks down.

When choosing car insurance, it’s important to assess your needs, budget, and state requirements. Consider factors such as the value of your car, your driving habits, and your financial situation. By understanding the different types of car insurance coverage, you can ensure that you have the right protection in place for your specific circumstances.